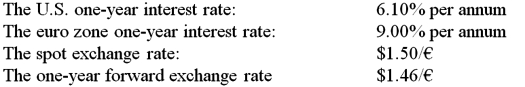

Suppose that Boeing Corporation exported a Boeing 747 to Lufthansa and billed €10 million payable in one year. The money market interest rates and foreign exchange rates are given as follows:  Assume that Boeing sells a currency forward contract of €10 million for delivery in one year, in exchange for a predetermined amount of U.S. dollar. Which of the following is (or are) true? On the maturity date of the contract Boeing will:

Assume that Boeing sells a currency forward contract of €10 million for delivery in one year, in exchange for a predetermined amount of U.S. dollar. Which of the following is (or are) true? On the maturity date of the contract Boeing will:

(i) have to deliver €10 million to the bank (the counterparty of the forward contract)

(ii) take delivery of $14.6 million

(iii) have a zero net pound exposure

(iv) have a profit, or a loss, depending on the future changes in the exchange rate, from this British sale

A) (i) and (iv)

B) (ii) and (iv)

C) (ii) , (iii) , and (iv)

D) (i) , (ii) , and (iii)

Correct Answer:

Verified

Q4: If you own a foreign currency denominated

Q10: The sensitivity of the firm's consolidated financial

Q12: Your firm has a British customer that

Q13: Suppose that Boeing Corporation exported a Boeing

Q14: A Japanese EXPORTER has a €1,000,000 receivable

Q15: Since a corporation can hedge exchange rate

Q17: The sensitivity of "realized" domestic currency values

Q17: If you owe a foreign currency denominated

Q20: The choice between a forward market hedge

Q21: Your firm is an Italian exporter of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents