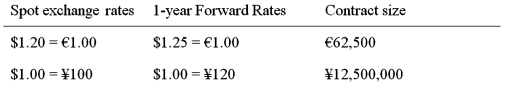

A Japanese EXPORTER has a €1,000,000 receivable due in one year. Spot and forward exchange rate data is given in the table:  The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%. Detail a strategy using forward contract that will hedge exchange rate risk.

The one-year risk free rates are i$ = 4.03%; i€ = 6.05%; and i¥ = 1%. Detail a strategy using forward contract that will hedge exchange rate risk.

A) Borrow €970,873.79 today; in one year you owe €1m, which will be financed with the receivable. Convert €970,873.79 to dollars at spot, receive $1,165,048.54. Convert dollars to yen at spot, receive ¥116,504,854.

B) Sell €1m forward using 16 contracts at the forward rate of $1.20 per €1. Buy ¥150,000,000 forward using 11.52 contracts, at the forward rate of $1.00 = ¥120.

C) Sell €1m forward using 16 contracts at the forward rate of $1.25 per €1. Buy ¥150,000,000 forward using 12 contracts, at the forward rate of $1.00 = ¥120.

D) None of the above

Correct Answer:

Verified

Q4: If you own a foreign currency denominated

Q9: The most direct and popular way of

Q10: With any successful hedge

A)you are guaranteed to

Q10: The sensitivity of the firm's consolidated financial

Q12: Your firm has a British customer that

Q13: Suppose that Boeing Corporation exported a Boeing

Q15: Since a corporation can hedge exchange rate

Q16: Suppose that Boeing Corporation exported a Boeing

Q17: The sensitivity of "realized" domestic currency values

Q17: If you owe a foreign currency denominated

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents