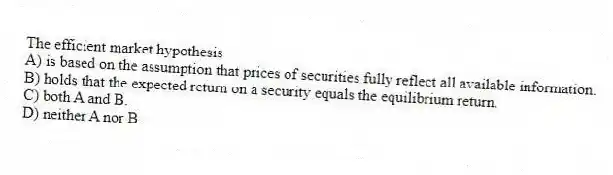

The efficient market hypothesis

A) is based on the assumption that prices of securities fully reflect all available information.

B) holds that the expected return on a security equals the equilibrium return.

C) both A and B.

D) neither A nor B.

Correct Answer:

Verified

Q13: A situation in which the price of

Q14: To say that stock prices follow a

Q15: Raj Rajaratnam,a successful investor in the 2000s

Q16: Tests used to rate the performance of

Q17: Another way to state the efficient market

Q19: Another way to state the efficient market

Q20: How expectations are formed is important because

Q21: Mean reversion refers to the observation that

A)

Q22: An arrangement with a broker to borrow

Q23: Evidence in favor of market efficiency does

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents