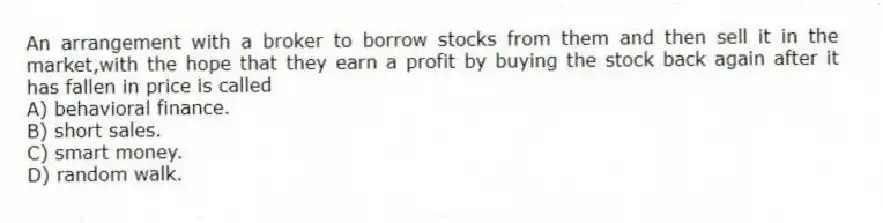

An arrangement with a broker to borrow stocks from them and then sell it in the market,with the hope that they earn a profit by buying the stock back again after it has fallen in price is called

A) behavioral finance.

B) short sales.

C) smart money.

D) random walk.

Correct Answer:

Verified

Q17: Another way to state the efficient market

Q18: The efficient market hypothesis

A) is based on

Q19: Another way to state the efficient market

Q20: How expectations are formed is important because

Q21: Mean reversion refers to the observation that

A)

Q23: Evidence in favor of market efficiency does

Q24: Evidence in favor of market efficiency includes

A)

Q25: Evidence against market efficiency does not include

A)

Q26: According to the January effect,stock prices

A) experience

Q27: The elimination of a riskless profit opportunity

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents