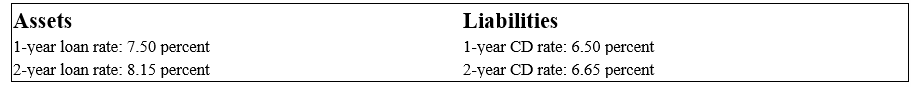

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-If the FI finances a $500,000 2-year loan with a $400,000 1-year CD and equity,what is the leveraged adjusted duration gap of this position? Use your answer to the previous question.

A) +1.25 years

B) +1.12 years

C) -1.12 years

D) +0.92 years

Correct Answer:

Verified

Q79: Why does immunization against interest rate shocks

Q80: What is the duration of an 8

Q81: The following information is about current spot

Q82: The following information is about current spot

Q83: What is the percentage price change for

Q85: What is the FI's interest rate risk

Q86: The following information is about current spot

Q87: What conclusions can you draw from the

Q88: The following information is about current spot

Q89: Third Duration Investments has the following assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents