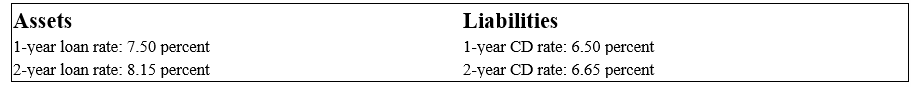

The following information is about current spot rates for Second Duration Savings' assets (loans) and liabilities (CDs) . All interest rates are fixed and paid annually.

-Use the duration model to approximate the change in the market value (per $100 face value) of two-year loans if interest rates increase by 100 basis points.

A) -$1.756

B) -$1.775

C) +$98.24

D) -$1.000

Correct Answer:

Verified

Q76: Which of the following statements is true?

A)The

Q77: Calculating modified duration involves

A)dividing the value of

Q79: Why does immunization against interest rate shocks

Q80: What is the duration of an 8

Q82: The following information is about current spot

Q83: What is the percentage price change for

Q84: The following information is about current spot

Q85: What is the FI's interest rate risk

Q86: The following information is about current spot

Q95: An FI purchases at par value a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents