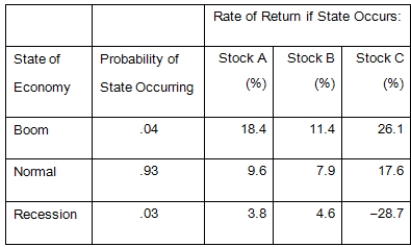

Given the following information,what is the expected return on a portfolio that is invested 30 percent in both Stocks A and C,and 40 percent in Stock B?

A) 11.08 percent

B) 12.94 percent

C) 12.33 percent

D) 10.84 percent

E) 10.42 percent

Correct Answer:

Verified

Q22: Given the following information,what is the standard

Q22: The beta of a risky portfolio cannot

Q24: Bruno's stock should return 14 percent in

Q27: Given the following information,what is the expected

Q28: Which one of these represents systematic risk?

A)Major

Q28: Fiddler's Music Stores' stock has a risk

Q30: Westover stock is expected to return 36

Q35: The addition of a risky security to

Q38: Which statement is correct?

A)An underpriced security will

Q55: Julie wants to create a $5,000 portfolio.She

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents