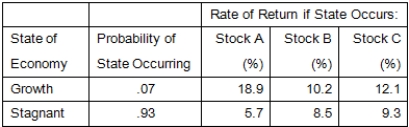

Given the following information,what is the standard deviation of the returns on a portfolio that is invested 40 percent in Stock A, 35 percent in Stock B, and the remainder in Stock C?

A) 1.68 percent

B) 6.72 percent

C) 3.16 percent

D) 2.43 percent

E) 16.57 percent

Correct Answer:

Verified

Q4: The security market line is defined as

Q13: The amount of systematic risk present in

Q16: Which one of the following statements is

Q22: The beta of a risky portfolio cannot

Q24: Bruno's stock should return 14 percent in

Q25: Given the following information,what is the expected

Q27: Given the following information,what is the expected

Q28: Which one of these represents systematic risk?

A)Major

Q38: Which statement is correct?

A)An underpriced security will

Q55: Julie wants to create a $5,000 portfolio.She

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents