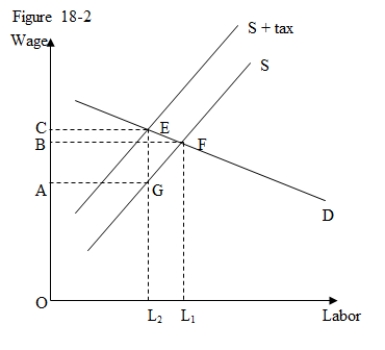

The figure given below shows the demand and supply curves of labor.A per-unit tax imposed on the wage income of the employees shifts the supply curve of labor upward.

-In Figure 18-2,as a result of a per-unit tax:

A) the total wage paid by employers rises,while the net-wage received by employees declines.

B) the total wage paid by employers declines,while the net-wage received by the employees rises.

C) the total wage paid by employers declines.

D) the total wage received by employees decline.

Correct Answer:

Verified

Q21: The real burden of a social security

Q22: The federal minimum wage is:

A)not likely an

Q24: Which of the following will result from

Q26: The figure given below shows the demand

Q30: The figure given below shows the demand

Q32: Which of the following is true regarding

Q33: Most of a payroll tax is eventually

Q37: Empirical evidence suggests that a large majority

Q38: A change in the social security system

Q39: An aggregate labor supply curve is likely

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents