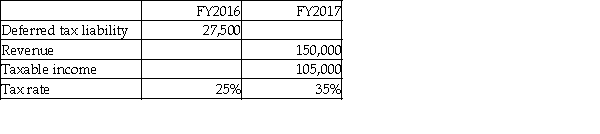

Under the accrual method,what is the FY2017 tax expense before making any adjustments for deferred tax liabilities?

A) 11,000

B) 42,500

C) 52,500

D) 63,500

Correct Answer:

Verified

Q6: A company facing a 45% tax rate

Q21: A company earns $390,000 in pre-tax income,while

Q22: A company earns $490,000 in pre-tax income,while

Q23: What is the income tax payable under

Q25: Match the following terms with their definitions.

Q26: Withering Inc.began operations in 2015.Due to the

Q29: What is the deferred tax liability under

Q31: Under the accrual method,what is the current

Q35: Which of the following is true?

A)A deductible

Q36: What is a deferred tax asset?

A)A deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents