Related Questions

Q6: A company facing a 45% tax rate

Q20: What is the income tax payable under

Q22: A company earns $490,000 in pre-tax income,while

Q23: What is the income tax payable under

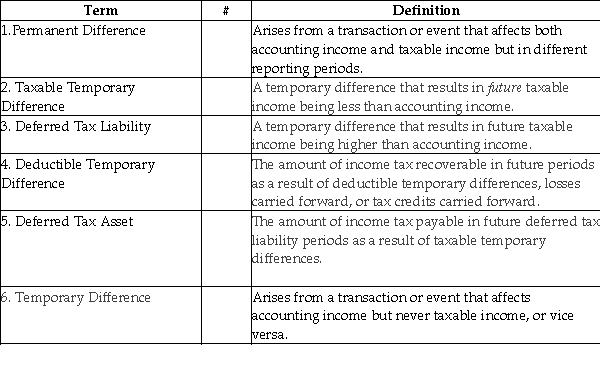

Q25: Describe what is meant by a timing

Q26: Withering Inc.began operations in 2015.Due to the

Q28: Under the accrual method,what is the FY2017

Q29: What is the deferred tax liability under

Q32: Describe what is meant by a permanent

Q36: What is a deferred tax asset?

A)A deductible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents