The following data represent the differences between accounting and tax income for Seafood Imports Inc. ,whose pre-tax accounting income is $650,000 for the year ended December 31.The company's income tax rate is 45%.Additional information relevant to income taxes includes the following.

a.Capital cost allowance of $270,000 exceeded accounting depreciation expense of $160,000 in the current year.

b.Rents of $25,000,applicable to next year,had been collected in December and deferred for financial statement purposes but are taxable in the year received.

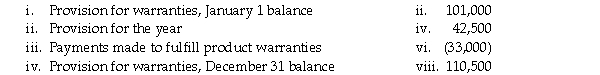

c.In a previous year,the company established a provision for product warranty expense.A summary of the current year's transactions appears below:

For tax purposes,only actual amounts paid for warranties are deductible.

d.Insurance expense to cover the company's executive officers was $6,800 for the year,and you have determined that this expense is not deductible for tax purposes.

Required:

Prepare the journal entries to record income taxes for Seafood Imports.

Correct Answer:

Verified

Journal entries fo...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q29: Why is it necessary to distinguish permanent

Q44: The following information relates to the accounting

Q47: Indicate whether the item would result in

Q51: Indicate whether the item will result in

Q52: For each of the following differences between

Q54: At the beginning of the current fiscal

Q54: The following summarizes information relating to Gonzalez

Q55: A company has income before tax of

Q56: A company has income before tax of

Q60: When will there be recapture and a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents