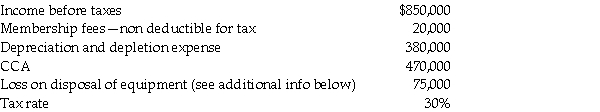

The following information relates to the accounting income for Ontario Uranium Enterprises (OUE)for the current year ended December 31.

During the year,the company sold one of its machines with carrying value of $85,000 for proceeds of $10,000,resulting in an accounting loss of $75,000.This loss has been included in the pre-tax income figure of $850,000 shown above.For tax purposes,the proceeds from the disposal were removed from the undepreciated capital cost (VCC)of Class 8 assets.

The deferred income tax liability account on January 1 had a credit balance of $230,000.This balance is entirely related to property,plant,and equipment (PPE).

Required:

Prepare the journal entries to record income taxes for OUE.

Correct Answer:

Verified

*The accounting loss is not currently ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q22: Which statement is correct?

A)Undepreciated capital cost (UCC)is

Q30: Which of the following is an example

Q40: What is the deferred tax liability under

Q42: The following summarizes information relating to Gonzalez

Q47: When will there be a recapture of

Q47: Indicate whether the item would result in

Q49: The following data represent the differences between

Q54: At the beginning of the current fiscal

Q55: A company has income before tax of

Q56: A company has income before tax of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents