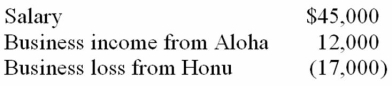

Ms. Mollani owns stock in two S corporations, Aloha and Honu. This year, she had the following income and loss items:  Compute Sheila's AGI under each of the following assumptions.

Compute Sheila's AGI under each of the following assumptions.

a. She materially participates in Aloha's business but not in Honu's business.

b. She materially participates in Honu's business but not in Aloha's business.

c. She materially participates in both corporate businesses.

d. She does not materially participate in either business.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q92: Bess gave her grandson ten acres of

Q94: Mr. Vernon owns stock in two S

Q97: Mr. Lainson died this year on a

Q98: Mr. and Mrs. Gupta want to make

Q99: Which of the following reduce a decedent's

Q99: Mr. Lee made the following transfers this

Q100: Mr. McCann died this year. During his

Q101: Mr. Ames, an unmarried individual, made a

Q102: Mr. Carp, a single taxpayer, recognized a

Q108: Beverly earned a $75,000 salary and recognized

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents