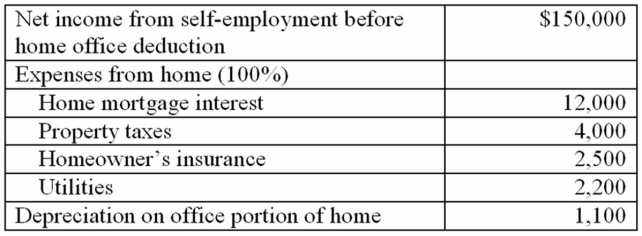

Aaron James has a qualifying home office. The office is 500 square feet and the entire house is 2,500 square feet. Use the following information to determine his allowable home office deduction:

A) $5,240

B) $4,140

C) $4,260

D) $21,800

Correct Answer:

Verified

Q22: A shareholder in an S corporation includes

Q23: The earnings of a C corporation are

Q24: John's share of partnership loss was $60,000.

Q27: If a business is formed as an

Q30: A limited liability company with more than

Q32: Corporations cannot be shareholders in an S

Q37: A limited liability company is always taxed

Q38: The shareholders of an S corporation must

Q38: Kelly received a $60,000 salary during 2012.

Q41: Waters Corporation is an S corporation with

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents