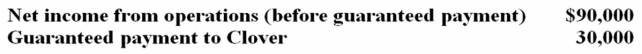

Hay, Straw and Clover formed the HSC Partnership, agreeing to share profits and losses equally. Clover will manage the business for which he will receive a guaranteed payment of $30,000 per year. Cash receipts and disbursements for the year were as follows:  What is Clover's share of the partnership's ordinary income and guaranteed payment?

What is Clover's share of the partnership's ordinary income and guaranteed payment?

A) Ordinary income, $30,000; Guaranteed payment, $10,000

B) Ordinary income, $20,000; Guaranteed payment, $10,000

C) Ordinary income, $30,000; Guaranteed payment, $30,000

D) Ordinary income, $20,000; Guaranteed payment, $30,000

Correct Answer:

Verified

Q44: Martha Pim is a general partner in

Q45: Which of the following statements about partnerships

Q47: In 2012, Mike Elfred received a $165,000

Q54: During 2012, Elena generated $24,500 of earnings

Q55: Sue's 2012 net (take-home) pay was $23,805.

Q56: Waters Corporation is an S corporation with

Q57: Waters Corporation is an S corporation with

Q59: Debbie is a limited partner in ADK

Q70: Cramer Corporation and Mr. Chips formed a

Q72: Cramer Corporation and Mr. Chips formed a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents