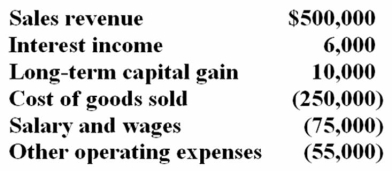

Waters Corporation is an S corporation with two equal shareholders, Mia Jones and David Kerns. This year, Waters recorded the following items of income and expense:  Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

Waters distributed $25,000 to each of its shareholders during the year. Calculate the S corporation's ordinary (non-separately stated) income and indicate which items must be separately stated.

A) Ordinary income, $126,000; long-term capital gain is separately stated

B) Ordinary income, $120,000; interest income and long-term capital gain are separately stated

C) Ordinary income, $136,000; nothing is separately stated

D) Ordinary income, $195,000; interest income, long-term capital gain, and salary costs are separately stated

Correct Answer:

Verified

Q48: Which of the following statements concerning partnerships

Q52: Hay, Straw and Clover formed the HSC

Q53: William is a member of an LLC.

Q54: During 2012, Elena generated $24,500 of earnings

Q55: Sue's 2012 net (take-home) pay was $23,805.

Q57: Waters Corporation is an S corporation with

Q59: Debbie is a limited partner in ADK

Q61: Funky Chicken is a calendar year S

Q67: Cramer Corporation and Mr. Chips formed a

Q72: Cramer Corporation and Mr. Chips formed a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents