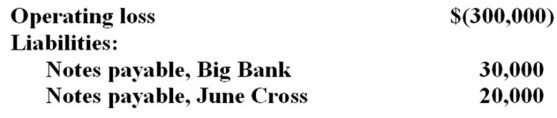

Funky Chicken is a calendar year S corporation with the following current year information:  On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

On January 1 June Cross bought 60% of Funky Chicken for $45,000. She then loaned the company $20,000. How much of the operating loss may Cross deduct on her Form 1040?

A) $57,000

B) $80,000

C) $65,000

D) $75,000

Correct Answer:

Verified

Q48: Which of the following statements concerning partnerships

Q53: William is a member of an LLC.

Q56: Waters Corporation is an S corporation with

Q57: Waters Corporation is an S corporation with

Q64: Which of the following statements regarding a

Q65: Cactus Company is a calendar year S

Q66: Mutt and Jeff are general partners in

Q67: Cramer Corporation and Mr. Chips formed a

Q87: Loretta is the sole shareholder of Country

Q93: Grant and Amy have formed a new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents