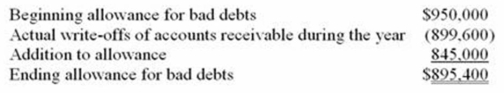

Earl Company uses the accrual method of accounting. Here is a reconciliation of Earl's allowance for bad debts for the current year.  Which of the following statements is true?

Which of the following statements is true?

A) Bad debt expense per books is $845,000, and the deduction for bad debts is $899,600.

B) Bad debt expense per books is $899,600, and the deduction for bad debts is $845,000.

C) Bad debt expense per books and the deduction for bad debts is $899,600.

D) Bad debt expense per books and the deduction for bad debts is $895,400.

Correct Answer:

Verified

Q101: This year,Garfield Inc.generated a $25,000 net operating

Q104: Valley Inc.incurred a $71,400 net operating loss

Q106: Which of the following statements about an

Q107: Two years ago, Ipenex Inc., an accrual

Q107: Monro Inc. uses the accrual method of

Q108: Ladow Inc. incurred a $32,000 net operating

Q110: Earl Company uses the accrual method of

Q112: Monro Inc. uses the accrual method of

Q115: Which of the following statements about the

Q115: Zephex is a calendar year corporation. On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents