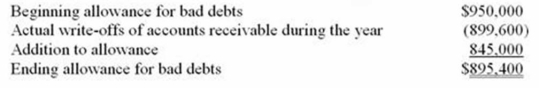

Earl Company uses the accrual method of accounting. Here is a reconciliation of Earl's allowance for bad debts for the current year.  Because of the difference between the GAAP rules and the tax rules for accounting for bad debts, Earl Company has a:

Because of the difference between the GAAP rules and the tax rules for accounting for bad debts, Earl Company has a:

A) $54,600 permanent excess of book income over taxable income.

B) $54,600 permanent excess of taxable income over book income.

C) $54,600 temporary excess of taxable income over book income.

D) $54,600 temporary excess of book income over taxable income.

Correct Answer:

Verified

Q101: This year,Garfield Inc.generated a $25,000 net operating

Q105: Krasco Inc.'s auditors prepared the following reconciliation

Q106: Which of the following statements about an

Q107: Two years ago, Ipenex Inc., an accrual

Q107: Monro Inc. uses the accrual method of

Q108: Ladow Inc. incurred a $32,000 net operating

Q112: Monro Inc. uses the accrual method of

Q113: Earl Company uses the accrual method of

Q115: Which of the following statements about the

Q115: Zephex is a calendar year corporation. On

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents