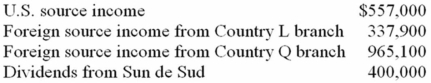

Sunny, a California corporation, earned the following income this year.  Sunny owns 100% of Sun de Sud, a foreign corporation operating a business in Country M and paying foreign income tax at a 50% rate. Sunny paid $124,000 foreign income tax to Country L, $203,000 income tax to Country Q, and no foreign withholding tax on its Sun de Sud dividends. Assuming a 34% tax rate, compute Sunny's U.S. tax.

Sunny owns 100% of Sun de Sud, a foreign corporation operating a business in Country M and paying foreign income tax at a 50% rate. Sunny paid $124,000 foreign income tax to Country L, $203,000 income tax to Country Q, and no foreign withholding tax on its Sun de Sud dividends. Assuming a 34% tax rate, compute Sunny's U.S. tax.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q81: Logan,an Indiana corporation,conducts its international business through

Q92: The Quad affiliated group consists of Quad,

Q93: Lincoln Corporation,which has a 34% marginal tax

Q95: Which of the following statements about subpart

Q96: In which of the following cases are

Q99: Koscil Inc. had the following taxable income.

Q100: Orchid Inc.,a U.S.multinational with a 34% marginal

Q102: Pogo,Inc.,which has a 34 percent marginal tax

Q107: This year, Plateau, Inc.'s before-tax income was

Q111: Transfer pricing issues arise:

A)When tangible goods are

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents