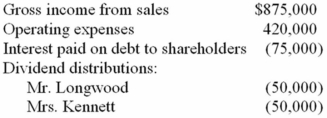

Mr. Longwood and Mrs. Kennett are the equal shareholders in LK Corporation. Both shareholders have a 39.6 percent marginal tax rate on ordinary income. LK's financial records show the following:  a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

a. Compute the combined tax cost for LK, Mr. Longwood, and Mrs. Kennett attributable to LK's operations.

b. How would your computation change if the interest on the shareholder debt was $175,000 and LK paid no dividends?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Which of the following statements regarding the

Q84: During a recent IRS audit,the revenue agent

Q86: Which of the following benefits does not

Q91: Which of the following statements regarding corporate

Q92: Andrews Corporation owns all of the outstanding

Q93: During a recent IRS audit, the revenue

Q94: Which of the following is not a

Q97: For the current tax year,Cuddle Corporation's $500,000

Q98: Mr.and Mrs.Maxwell and their two children (Alicia

Q99: Betsy Williams is the sole shareholder of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents