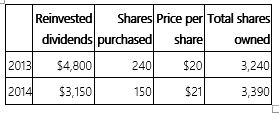

In 2013, Mrs. Owens paid $50,000 for 3,000 shares of a mutual fund and elected to reinvest dividends in additional shares. In 2013 and 2014, she received Form 1099s reporting the following.  If Mrs. Owens sells her 3,390 shares in 2015 for $22 per share, compute her recognized gain.

If Mrs. Owens sells her 3,390 shares in 2015 for $22 per share, compute her recognized gain.

A) $24,580

B) $19,780

C) $16,630

D) $0

Correct Answer:

Verified

Q48: Mr. Ricardo exchanged 75 shares of Haslet

Q55: Mr. Gordon, a resident of Pennsylvania, paid

Q62: In 2013, Mrs. Owens paid $50,000 for

Q66: This year,Ms.Kwan recognized a $16,900 net long-term

Q68: Kate recognized a $25,700 net long-term capital

Q68: Ms. Kerry, who itemized deductions on Schedule

Q74: Ms.Beal recognized a $42,400 net long-term capital

Q76: Mrs.Lindt exchanged 212 shares of Nipher common

Q78: Ms. Lopez paid $7,260 interest on a

Q80: In 1996, Mr. Exton, a single taxpayer,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents