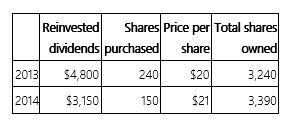

In 2013, Mrs. Owens paid $50,000 for 3,000 shares of a mutual fund and elected to reinvest dividends in additional shares. In 2013 and 2014, she received Form 1099s reporting the following.  If Mrs. Owens sells 1,000 shares in 2015 for $22 per share and uses the average basis method, compute her recognized gain.

If Mrs. Owens sells 1,000 shares in 2015 for $22 per share and uses the average basis method, compute her recognized gain.

A) $4,910

B) $5,333

C) $3,883

D) $0

Correct Answer:

Verified

Q48: Mr. Ricardo exchanged 75 shares of Haslet

Q53: Fifteen years ago, Lenny purchased an insurance

Q55: Mr. Gordon, a resident of Pennsylvania, paid

Q57: Which of the following statements about investment

Q64: In 2013, Mrs. Owens paid $50,000 for

Q66: This year,Ms.Kwan recognized a $16,900 net long-term

Q68: Kate recognized a $25,700 net long-term capital

Q74: Ms.Beal recognized a $42,400 net long-term capital

Q76: Mrs.Lindt exchanged 212 shares of Nipher common

Q78: Ms. Lopez paid $7,260 interest on a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents