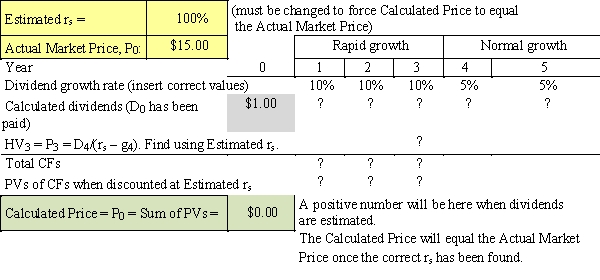

Your boss,Sally Maloney,treasurer of Fred Clark Enterprises (FCE) ,asked you to help her estimate the intrinsic value of the company's stock.FCE just paid a dividend of $1.00,and the stock now sells for $15.00 per share.Sally asked a number of security analysts what they believe FCE's future dividends will be,based on their analysis of the company.The consensus is that the dividend will be increased by 10% during Years 1 to 3,and it will be increased at a rate of 5% per year in Year 4 and thereafter.Sally asked you to use that information to estimate the required rate of return on the stock,rs,and she provided you with the following template for use in the analysis.

Sally told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated HV.She also notes that the estimated value for rs, at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process would be quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

Sally told you that the growth rates in the template were just put in as a trial,and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated HV.She also notes that the estimated value for rs, at the top of the template,is also just a guess,and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that,after you have put in the correct dividends,you can manually calculate the price,using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes,though,that this trial-and-error process would be quite tedious,and that the correct rs could be found much faster with a simple Excel model,especially if you use Goal Seek.What is the value of rs?

A) 11.84%

B) 12.21%

C) 12.58%

D) 12.97%

E) 13.36%

Correct Answer:

Verified

Q79: Goode Inc.'s stock has a required rate

Q80: Schnusenberg Corporation just paid a dividend of

Q81: Ackert Company's last dividend was $1.55.The dividend

Q82: Savickas Petroleum's stock has a required return

Q83: Agarwal Technologies was founded 10 years ago.It

Q84: Church Inc.is presently enjoying relatively high growth

Q85: Huang Company's last dividend was $1.25.The dividend

Q86: The Ramirez Company's last dividend was $1.75.Its

Q87: Wall Inc.forecasts that it will have the

Q88: Nachman Industries just paid a dividend of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents