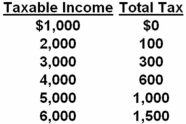

Refer to the above data.If your taxable income is $4000,your average tax rate will be:

Refer to the above data.If your taxable income is $4000,your average tax rate will be:

A) 20 percent.

B) 15 percent.

C) 10 percent.

D) 5 percent.

At $4000 of taxable income your average tax rate is 15 percent (i.e. ,$600 tax paid/$4000 income) .

Correct Answer:

Verified

Q23: The main difference between sales and excise

Q31: The basic tax rate on taxable corporate

Q35: Government lotteries are

A) used by a large

Q50: The benefits-received principle of taxation is most

Q53: Approximately what percentage of state spending goes

Q54: With respect to state finance,for most states:

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents