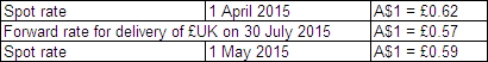

Sure Ltd purchased goods for £210 000 from a British supplier on 1 April 2015.The amount owing on the purchase is payable on 30 July 2015.On 1 May 2015 a forward-exchange contract for the delivery of £210 000 on 30 July 2015 is taken out with Aus Bank.Exchange rates are as follows:  What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole A$) ?

What entries are required to record the initial transaction and the forward-exchange contract in accordance with AASB 121 and AASB 139 (rounded to the nearest whole A$) ?

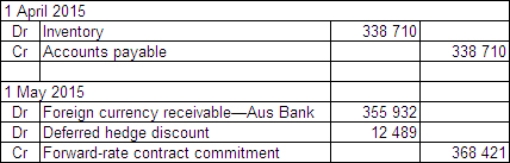

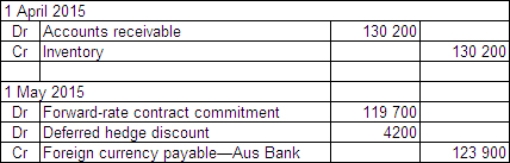

A)

B)

C)

D)

Correct Answer:

Verified

Q44: On 1 July 2015 Jarrets Ltd

Q45: Emu Exports Ltd sold products to

Q46: Which of the following statements is correct

Q47: For a cash flow hedge relating to

Q48: On 1 February 2014,Morinda Ltd completes

Q50: The three principal types of hedges referred

Q51: Exchange differences recognised as borrowing costs and

Q52: On 1 July 2013 Kanga Consultants

Q53: AASB 123 Borrowing Costs defines a qualifying

Q54: On 1 July 2015 Jarrets Ltd

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents