On 1 July 2015 Jarrets Ltd borrows £500 000 from a British bank at an interest rate of 8 per cent,repayable in pounds sterling (£) and with interest due on 30 June each year.The term of the loan is 3 years.On the same date Fitners Ltd borrows A$1 million from an Australian bank at an interest rate of 10 per cent.The term of the loan is 3 years.Jarrets and Fitners decide to swap their interest and principal obligations on 1 July 2015.Exchange rate information is as follows: Both Jarrets and Fitners are Australian companies.What are the journal entries to record the swap for the period ended 30 June 2016 in Fitners Ltd's books (rounded to the nearest whole A$) ?

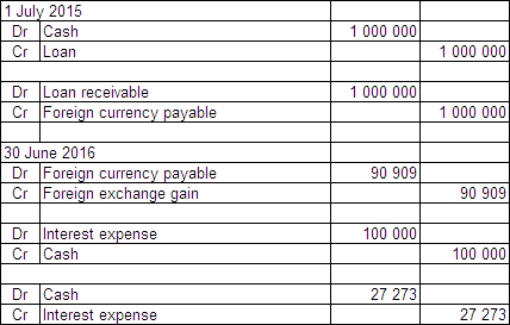

A)

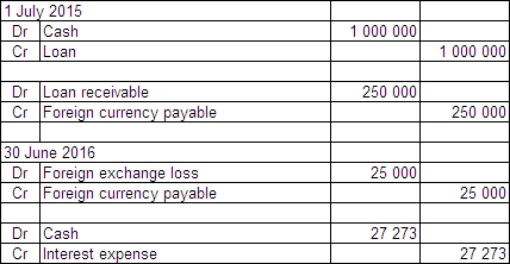

B)

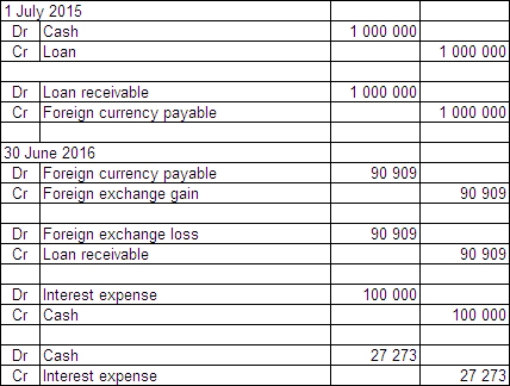

C)

D)

Correct Answer:

Verified

Q49: Sure Ltd purchased goods for £210 000

Q50: The three principal types of hedges referred

Q51: Exchange differences recognised as borrowing costs and

Q52: On 1 July 2013 Kanga Consultants

Q53: AASB 123 Borrowing Costs defines a qualifying

Q55: In terms of retrospectively assessing hedge effectiveness,which

Q56: Common examples of qualifying assets are assets

Q57: Which of the following is not a

Q58: The hedge effectiveness criteria prescribed in AASB

Q59: Safety Ltd purchased goods for £20 000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents