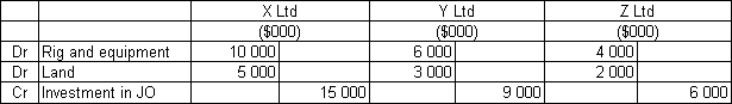

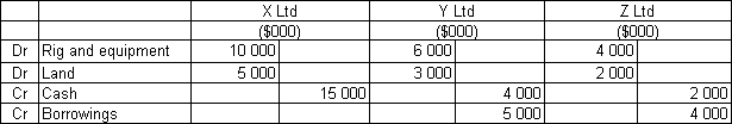

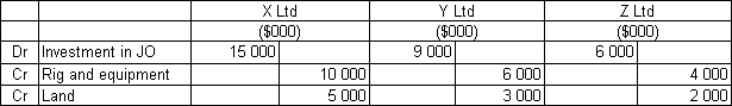

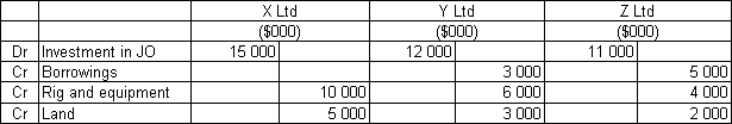

X Ltd,Y Ltd and Z Ltd contractually form a joint operation on 1 July 2013 to construct an oil well to extract oil that each of the joint operators will refine.The three companies agree to contribute the following amounts of capital to the joint operation in the same proportion as their rights to the assets and outputs: The funds are used on 1 July 2013 to purchase the land for $20 million and a rig and other equipment for $10 million.The balance of $20 million will be called on by the joint operation manager as required.Y Ltd and Z Ltd borrowed $5 million and $4 million respectively to finance their contributions to the joint operation.What entries would be required to record the establishment of the joint operation and where would these entries be made?

A)  The entries would be consolidation journal entries for each joint operator.

The entries would be consolidation journal entries for each joint operator.

B)  The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

C)  The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

D)  The entries would be made in each joint operator's own books.

The entries would be made in each joint operator's own books.

Correct Answer:

Verified

Q46: A venturer that recognises in its financial

Q47: Quartermain Limited has the following investments:

1)Christian Limited-a

Q48: Creed Ltd and Nickleback Ltd enter

Q49: A joint operation should be accounted for

Q50: A joint operation:

A) is a jointly controlled

Q52: In determining the existence of 'significant influence',and

Q53: Sting Ltd and Pink Ltd enter

Q54: Have Ltd,Ay Ltd and Go Ltd

Q55: Which of the following statements is in

Q56: Bush Ltd and Forest Ltd enter

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents