Bush Ltd and Forest Ltd enter into a contractual agreement to form a joint arrangement which is considered to be a joint operation on 1 July 2014.Bush Ltd is to contribute land and equipment.Forest Ltd agrees to contribute $5.1 million in cash.It is agreed that they will share output,assets and future contributions in the ratio 70: 30 (Bush/Forest) .The following information relates to the contribution by Bush Ltd:

The following information relates to the year ending 30 June 2015:

Total cost of production of $5 000 000.These costs have been deferred in order to amortise them as production commences.

Of the total costs of production all but $1 000 000 have been paid in cash.

The joint venture manager called on the venturers to contribute a further $4 500 000 in total with each venturer contributing the appropriate portion according to their share in the joint operation.

What entries would be required to record the formation of the joint operation and the transactions for the year ended 30 June 2014?

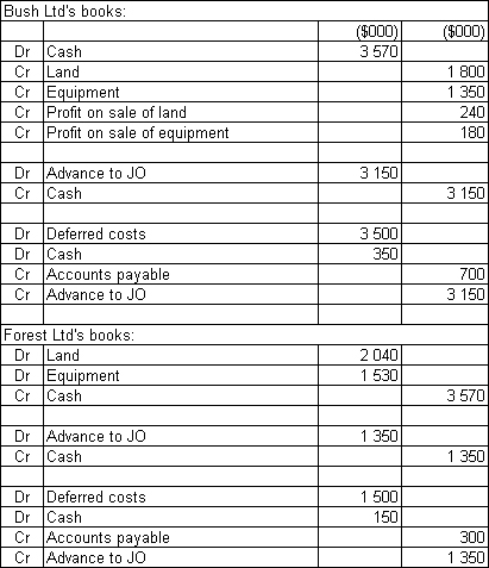

A)

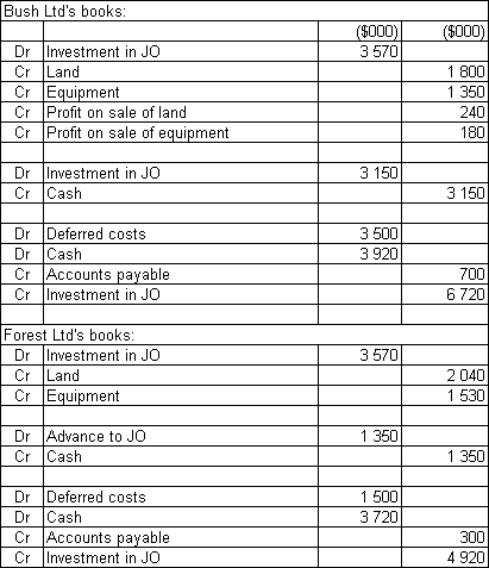

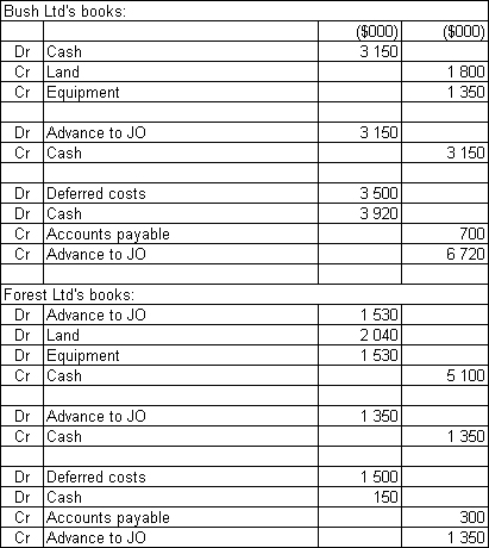

Bush Ltd's books:

B)

C)

D)

Correct Answer:

Verified

Q51: X Ltd,Y Ltd and Z Ltd

Q52: In determining the existence of 'significant influence',and

Q53: Sting Ltd and Pink Ltd enter

Q54: Have Ltd,Ay Ltd and Go Ltd

Q55: Which of the following statements is in

Q57: Where a joint venture is a partnership:

A)

Q58: A joint arrangement that is not structured

Q59: On 30 June 2013,Perkins Ltd,Thorpe Ltd

Q60: Quartermain Limited has the following investments:

1)Christian Limited-a

Q61: Explain the term 'significant influence',and how it

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents