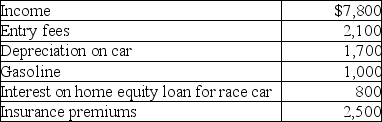

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

A) $0

B) $300

C) $1,400

D) $1,700

Correct Answer:

Verified

Q96: If property that qualifies as a taxpayer's

Q120: Bart owns 100% of the stock of

Q121: Ola owns a cottage at the beach.She

Q122: Lindsey Forbes,a detective who is single,operates a

Q123: Juanita knits blankets as a hobby and

Q125: During the current year,Paul,a single taxpayer,reported the

Q126: Mackensie owns a condominium in the Rocky

Q127: Lloyd purchased 100 shares of Gold Corporation

Q128: Vanessa owns a houseboat on Lake Las

Q481: Diane, a successful accountant with an annual

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents