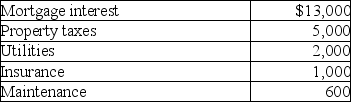

Ola owns a cottage at the beach.She and her family use the property for 30 days during the summer season and rent it to unrelated parties for 60 days.The rental receipts amount to $8,000.Total costs of operating the property are as follows:

In addition,potential depreciation expense is $9,000.

In addition,potential depreciation expense is $9,000.

a.Is the cottage subject to the vacation home rental limitations of IRC Sec.280A?

b.How much of expenses can Ola deduct?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q87: The term "principal place of business" includes

Q96: If property that qualifies as a taxpayer's

Q98: Expenses related to a hobby are deductible

Q118: Which of the following factors is not

Q120: Bart owns 100% of the stock of

Q122: Lindsey Forbes,a detective who is single,operates a

Q123: Juanita knits blankets as a hobby and

Q124: Kyle drives a race car in his

Q125: During the current year,Paul,a single taxpayer,reported the

Q126: Mackensie owns a condominium in the Rocky

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents