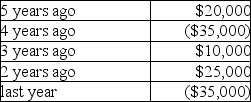

For this tax year,Madison Corporation had taxable income of $80,000 before using any of the net operating loss from the previous year.Madison has never elected to forgo the carryback of its losses since incorporation five years ago.Madison's books and records reflect the following income (loss) since its incorporation.  What amount of taxable income (loss) should Madison report on its current tax return?

What amount of taxable income (loss) should Madison report on its current tax return?

A) $45,000

B) $65,000

C) $70,000

D) $80,000

Correct Answer:

Verified

Q21: Identify which of the following statements is

Q29: A corporation has the following capital gains

Q32: Various members of Congress favor a reduction

Q33: A corporation has the following capital gains

Q34: With respect to charitable contributions by corporations,all

Q35: Musketeer Corporation has the following income and

Q36: A U.S.-based corporation produces cereal in Niagara

Q37: June Corporation has the following income and

Q38: Louisiana Land Corporation reported the following results

Q53: Charades Corporation is a publicly held company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents