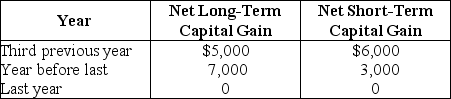

Lass Corporation reports a $25,000 net capital loss this year.The corporation reports the following net capital gains during the past three years.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: Identify which of the following statements is

Q56: Miller Corporation has gross income of $100,000,which

Q57: Money Corporation has the following income and

Q58: West Corporation purchases 50 shares (less than

Q59: Chambers Corporation is a calendar year taxpayer

Q62: Courtney Corporation had the following income and

Q64: Carter Corporation reports the following results for

Q66: How does the use of an NOL

Q72: What are the various levels of stock

Q76: When computing corporate taxable income, what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents