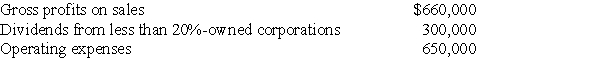

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Chambers Corporation is a calendar year taxpayer

Q60: Lass Corporation reports a $25,000 net capital

Q62: Courtney Corporation had the following income and

Q66: How does the use of an NOL

Q66: Francine Corporation reports the following income and

Q67: Bermuda Corporation reports the following results in

Q68: Describe the domestic production activities deduction.

Q69: Zerotech Corporation donates the following property to

Q72: What are the various levels of stock

Q76: When computing corporate taxable income, what is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents