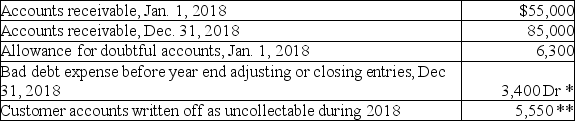

The accounting records of 10Com Ltd.show the following for 2018:

*The credit side of the journal entry (or entries)related to this amount went to allowance for doubtful accounts.

** Account write-offs were debited to the allowance for doubtful accounts.

More Info

For 2018,cash sales were $970,000,while credit sales were $720,000.Recently,10Com's management has become concerned about various estimates used in its accounting system,including those relating to receivables and uncollectable accounts.The company is considering two alternatives.

For the purpose of comparing these two alternatives,the company has made the following estimates for each alternative.

• Alternative 1: Bad debts approximating 0.7% of credit sales.

• Alternative 2: Aging of the accounts receivable at the end of the period,where 80% would incur a 2% loss,while the remaining 20% would incur a 9% loss.

Required:

For each of the two alternatives listed above,calculate the bad debts expense for 2018 and the allowance for doubtful accounts balance at the end of 2018.

Correct Answer:

Verified

* ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q103: Explain what is meant by "channel stuffing"

Q104: Gossamer Furnishings extends generous payment terms to

Q106: Explain how a company can use its

Q107: Explain how a company's revenue recognition policy

Q109: McGraw Motors both sells and leases vehicles.

Q110: Johnson Credit Union is a small, regional

Q111: Eastwick Company is preparing its financial statement

Q115: What is a "promissory note"?

A)A written promise

Q116: Which of the following is a difference

Q118: Explain why an allowance for doubtful accounts

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents