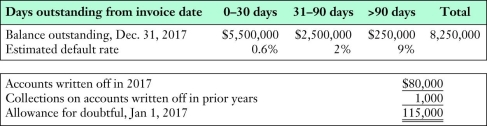

Eastwick Company is preparing its financial statement for the year ended December 31,2017.A summary of Eastwick's accounts receivable sub-ledger shows the following information:

Required:

a.Calculate the amount of bad debts expense required for 2017.

b.Present the journal entry to record bad debts expense for 2017.

c.Present the journal entry that was used to record write-offs for 2017.

d.Independent of the information above,suppose Eastwick factored $1,500,000 of receivables without recourse.In exchange,it received $1,380,000.Present the journal entry to record this transfer of receivables.

e.Independent of part (d),Eastwick instead factored the $1,500,000 of receivables with recourse and received $1,430,000 cash.Both Eastwick and the factor anticipate that 2% of these receivables will prove to be uncollectable,so the factor has held this amount to cover any uncollectable accounts.Should the amount of uncollectable accounts prove to be more or less than 2%,the difference will be paid by/refunded to Eastwick.Present the journal entry to record this transfer of receivables.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q104: Gossamer Furnishings extends generous payment terms to

Q105: Speed Motorcycles sold $550,000 of receivables to

Q106: Explain how a company can use its

Q106: Soorya Inc.had the following balances for fiscal

Q107: Explain how a company's revenue recognition policy

Q108: At December 31,2018,Pinebrook Inc.reported $135,000 in accounts

Q110: Johnson Credit Union is a small, regional

Q115: What is a "promissory note"?

A)A written promise

Q116: Which of the following is a difference

Q116: The accounting records of 10Com Ltd.show the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents