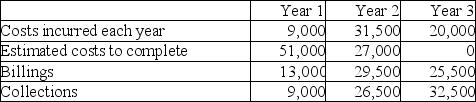

Apartment King (AK)is building a luxury condominium for a contract price of $68,000,000.This is estimated to be a three-year project with an estimated cost of $54,000,000.AK uses the percentage of completion method of revenue recognition,using the cost-to-cost method of estimating the percentage complete.The following is the best available information at the end of each year:

Required:

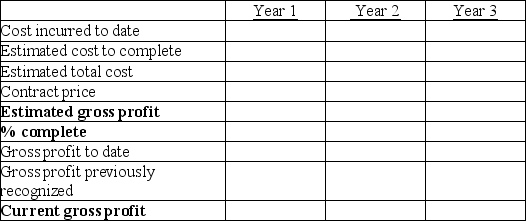

a.Calculate the amount of gross profit to be recognized in Year 1,Year 2,and Year 3.Show computations in tabular form provided below.

b.Prepare all the journal entries required in Year 2.

c.Prepare the journal entry required in Year 3 to close the accounts related to the project.

d.At the end of Year 2,if the estimated cost to complete is $28 million (instead of $27 million),how much gross profit would be recognized in Year 2?

Correct Answer:

Verified

b.(Year 2 - in $ ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q91: Which statement about the cost recovery method

Q92: What are three exceptions to the use

Q96: How is the prudence principle applied to

Q98: On July 1,2017,Cusak Construction Company Inc.contracted to

Q100: Smile Operators entered into a contract to

Q102: Destiny Apartments Inc.(DA Inc. )is building a

Q103: Coral Corporation builds large cruise ships on

Q104: Creation Construction Company (CCC)has contracted to build

Q105: Community Apartments Inc.(CA Inc. )is building a

Q106: In early 2015,Ecotravel Corp.won a contract to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents