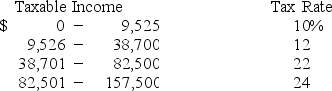

AC Motors is a sole proprietorship that has taxable income of $94,200.How much additional tax will be owed if the taxable income increases by $14,300 based on the following tax rates? Assume this is the sole source of income for the owner.

A) $3,862

B) $3,039

C) $3,406

D) $3,432

E) $3,678

Correct Answer:

Verified

Q61: Delfinio's has total revenues of $4,315,selling and

Q62: A firm has $820 in inventory,$3,200 in

Q63: Southwest Co.has equipment with a book value

Q64: At the beginning of the year,a firm

Q65: A debt-free firm has total sales of

Q67: A firm has $820 in inventory,$3,200 in

Q68: Total equity is $1,620,fixed assets are $1,810,long-term

Q69: Given the personal income tax rates as

Q70: Assume Juno's paid $368,060 in taxes on

Q71: At the beginning of the year,long-term debt

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents