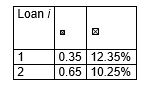

Consider the following table with information on the weightings and expected returns of two assets held by an FI.  What is the expected return on the portfolio (round to two decimals) ?

What is the expected return on the portfolio (round to two decimals) ?

A) (0.35 + 12.35) - (0.65 + 10.25) = 1.80%

B) (0.35 + 0.65) * (12.35 + 10.25) = 22.60%

C) (12.35 + 10.25) / 2 = 11.30%

D) 0.35 * 12.35 + 0.65 * 10.25 = 10.99%

Correct Answer:

Verified

Q2: Which of the following statements is true?

A)FIs

Q4: Which of the following statements is true?

A)Systematic

Q4: KMV Portfolio Manager is a model that:

A)

Q7: Which of the following statements is true?

A)FIs

Q9: Consider the following table with information on

Q10: Which of the following statements is true?

A)The

Q11: Minimum risk portfolio refers to a combination

Q11: Consider the following hypothetical transition matrix: Risk

Q14: Assume that the maximum loss as

Q19: Which of the following statements is true?

A)FIs

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents