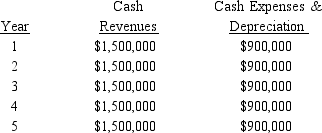

Figure 14-3.Davis Company is considering the purchase of a new piece of equipment that will cost $1,600,000 and have a life of five years with no expected salvage value. The expected cash flows associated with the project are as follows:

-Refer to Figure 14-3. What is the average annual income for this project?

A) $900,000

B) $1,500,000

C) $600,000

D) $700,000

E) $300,000

Correct Answer:

Verified

Q62: One disadvantage of the payback period is

Q68: A division manager was considering a project

Q91: Figure 14-4.Sony Lavery is considering investing $45,000

Q92: Figure 14-1.A company is considering two projects.

Q94: Figure 14-2.A company is considering two projects.

Q95: Figure 14-2.A company is considering two projects.

Q97: Tessa Wilson invested in a project with

Q99: Oakland Shop is considering the purchase of

Q100: Figure 14-4.Sony Lavery is considering investing $45,000

Q101: Figure 14-6.Present value of $1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents