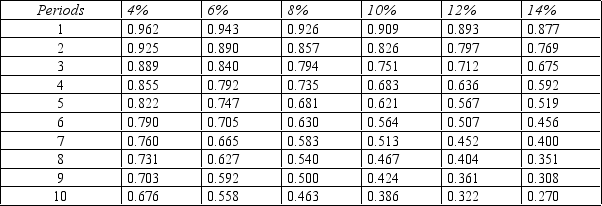

Figure 14-6.Present value of $1

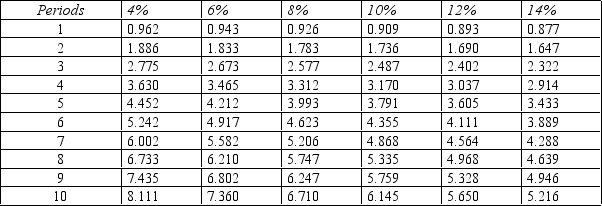

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Morgan Clinical Practice is considering an investment in new imaging equipment that will cost $400,000. The equipment is expected to yield cash inflows of $80,000 per year for a six year period. Morgan set a required rate of return at 10%. What is the net present value of the investment? (Note: there may be a rounding error depending on the table you use to compute your answer. Choose the answer closest to the one you calculate.)

A) $51,600

B) ($51,600)

C) $348,400

D) ($348,600)

E) $451,600

Correct Answer:

Verified

Q62: One disadvantage of the payback period is

Q94: A division manager is considering a project

Q96: Figure 14-3.Davis Company is considering the purchase

Q97: Tessa Wilson invested in a project with

Q99: Oakland Shop is considering the purchase of

Q100: Figure 14-4.Sony Lavery is considering investing $45,000

Q102: Figure 14-6.Present value of $1

Q104: The interest rate that sets the present

Q104: Figure 14-6.Present value of $1

Q106: Figure 14-6.Present value of $1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents