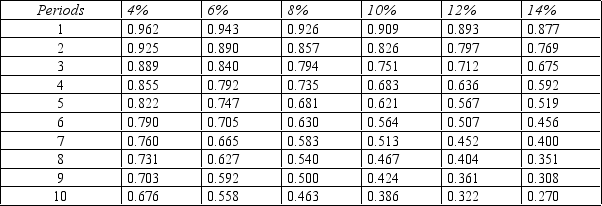

Figure 14-6.Present value of $1

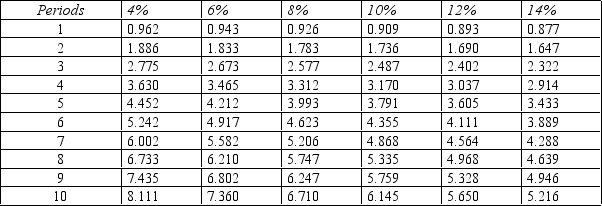

Present value of an Annuity of $1

Present value of an Annuity of $1

-Refer to Figure 14-6. Roman Knoze is considering two investments. Each will cost $20,000 initially. Project 1 will return annual cash flows of $10,000 in each of three years. Project 2 will return $5,000 in year 1, $10,000 in year 2, and $15,000 in year 3. Roman requires a minimum rate of return of 10%. What is the net present value of Project 1? (Note: there may be a rounding error depending on the table you use to compute your answer. Choose the answer closest to the one you calculate.)

A) $20,000

B) $25,670

C) $4,860

D) $22,530

E) $2,530

Correct Answer:

Verified

Q62: One disadvantage of the payback period is

Q94: A division manager is considering a project

Q97: Tessa Wilson invested in a project with

Q99: Oakland Shop is considering the purchase of

Q100: Figure 14-4.Sony Lavery is considering investing $45,000

Q101: Figure 14-6.Present value of $1

Q104: The interest rate that sets the present

Q104: Figure 14-6.Present value of $1

Q106: Figure 14-6.Present value of $1

Q107: Figure 14-7.Osler Company is considering an investment

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents