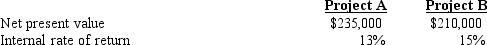

A division manager is choosing between two mutually exclusive projects.  The company requires any project to earn at least 12%. The manager believes that cash inflows from the project can be reinvested at the rate of 12%. Which project will the manager likely choose?

The company requires any project to earn at least 12%. The manager believes that cash inflows from the project can be reinvested at the rate of 12%. Which project will the manager likely choose?

A) Project B

B) Project A

C) both Projects A and B

D) neither Project A nor B

Correct Answer:

Verified

Q133: How do NPV and IRR differ?

A) NPV

Q140: The capital investment decision making model that

Q141: The earning of interest on interest is

A)

Q142: Brenning Company invested $3,000,000 in a new

Q143: Figure 14-10.Present value of $1

Q146: Barker Production Company is considering the purchase

Q147: Mistral Manufacturing is considering an investment in

Q148: Dale Davis Company is evaluating a proposal

Q149: The best model for choosing the best

Q150: Figure 14-10.Present value of $1

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents