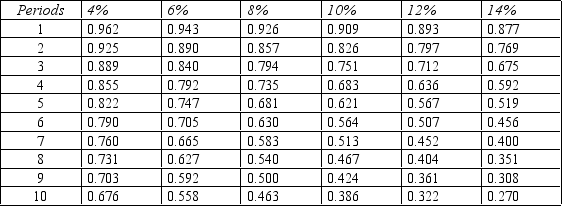

Figure 14-10.Present value of $1

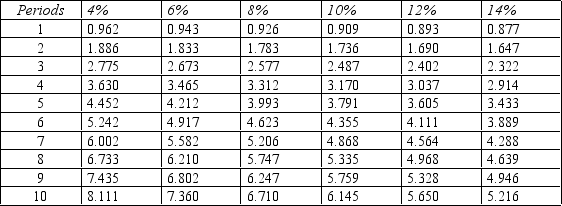

Present value of an Annuity of $1

Present value of an Annuity of $1

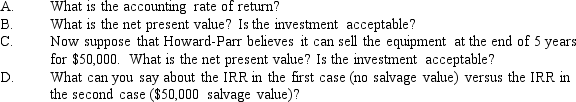

-Refer to Figure 14-10. Howard-Parr Company is considering an investment that will have an initial cost of $500,000 and yield annual net cash inflows of $130,000. Yearly depreciation will be $100,000. The equipment is expected to be useful for five years, at which point it will be scrapped with no salvage value. Howard-Parr requires a minimum rate of return of 10%.

Correct Answer:

Verified

Q122: Which of the following is not a

Q133: How do NPV and IRR differ?

A) NPV

Q139: Jerry Hall invested in a project that

Q140: The capital investment decision making model that

Q141: The earning of interest on interest is

A)

Q142: Brenning Company invested $3,000,000 in a new

Q145: A division manager is choosing between two

Q146: Barker Production Company is considering the purchase

Q147: Mistral Manufacturing is considering an investment in

Q148: Dale Davis Company is evaluating a proposal

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents