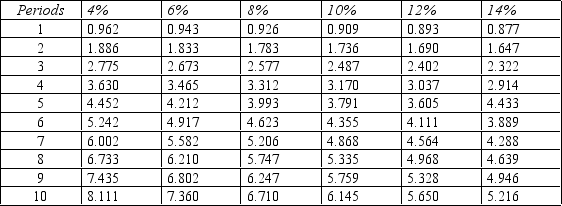

Figure 14-11.Present value of an Annuity of $1 in Arrears

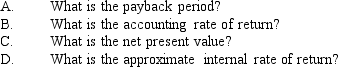

-Refer to Figure 14-11. Aragon Company is considering an investment in equipment that will have an initial cost of $560,290 and yield annual net cash inflows of $90,000. Yearly depreciation will be $56,000. The equipment is expected to be useful for 10 years and then it will be scrapped. Aragon requires a minimum rate of return of 10%.

Correct Answer:

Verified

Q162: What are some reasons why firms use

Q163: Figure 14-11.Present value of an Annuity of

Q164: Which model of capital investment decision making

Q165: Explain the relationship between current and future

Q166: Figure 14-11.Present value of an Annuity of

Q167: What is a postaudit? What are the

Q168: What is a capital investment decision? Give

Q169: Figure 14-10.Present value of $1

Q170: Name two nondiscounting capital investment models. What

Q171: Which model is better for independent projects

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents