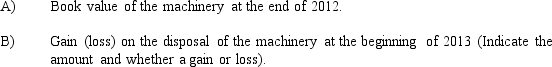

Farley Mills purchased new machinery at the beginning of 2012 for $200,000. The machines had an estimated life of 5 years, an estimated residual value of $25,000, and were depreciated using the straight-line method. At the beginning of 2013, the machines were sold for $150,000 because management was unhappy with their performance.Determine the following amounts:

Correct Answer:

Verified

Q112: Fabulous Creations

The assets section of the company's

Q114: Fabulous Creations

The assets section of the company's

Q158: A company purchased a building for $900,000

Q159: Fantasy Cruise Lines

On January 1, 2013, the

Q160: Given below are costs incurred during 2012

Q161: Flott Corp. purchased a machine on January

Q164: Explain the meaning or significance of the

Q166: Finicky Freight purchased a truck at the

Q168: Futronics purchased a truck at the beginning

Q188: Explain what costs are included in the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents