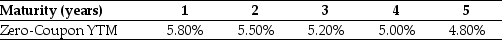

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-Which of the following equations is incorrect?

A) Expected future spot interest rate = forward interest rate + risk premium

B) (1 + f1) × (1 + f2) × (1 + f3) × ... × (1 + fn) = (1 + YTMn) n

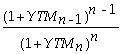

C) fn =  - 1

- 1

D) (1 + YTMn) n = (1 + YTMn - 1) n - 1(1 + fn)

Correct Answer:

Verified

Q86: Use the information for the question(s)below.

Luther Industries

Q93: Use the table for the question(s)below.

Consider the

Q96: Which of the following statements is false?

A)

Q97: Use the table for the question(s)below.

Consider the

Q98: The yield curves of bonds issued by

Q101: Which of the following statements is false?

A)

Q103: Which of the following statements is false?

A)

Q104: Which of the following statements is false?

A)

Q107: Use the table for the question(s)below.

Consider the

Q110: Explain why the expected return of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents