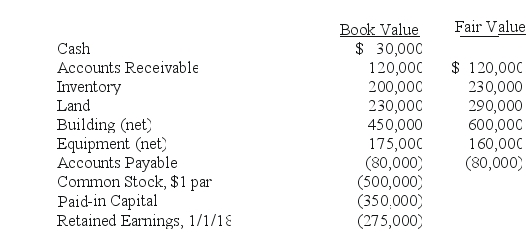

On January 1, 2018, Chester Inc.acquired 100% of Festus Corp.'s outstanding common stock by exchanging 37,500 shares of Chester's $2 par value common voting stock.On January 1, 2018, Chester's voting common stock had a fair value of $40 per share.Festus' voting common shares were selling for $6.50 per share.Festus' balances on the acquisition date, just prior to acquisition are listed below.

Required:

Required:

Compute the value of Goodwill on the date of acquisition, 1/1/18.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q88: What amount will be reported for consolidated

Q102: Bale Co.acquired Silo Inc.on December 31, 2018,

Q106: The following are preliminary financial statements for

Q106: Prepare the journal entries to record: (1)

Q106: Describe the accounting for direct costs, indirect

Q108: Jernigan Corp.had the following account balances at

Q110: How is contingent consideration accounted for in

Q110: The following are preliminary financial statements for

Q111: How are bargain purchases accounted for in

Q116: Assume that Bellington paid cash of $2.8

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents