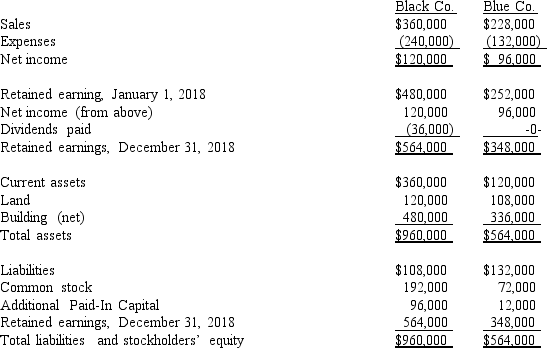

The following are preliminary financial statements for Black Co.and Blue Co.for the year ending December 31, 2018, prior to Black's acquisition of Blue Co.

On December 31, 2018 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $50 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.

On December 31, 2018 (subsequent to the preceding statements), Black exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Blue.Black's stock on that date has a fair value of $50 per share.Black was willing to issue 10,000 shares of stock because Blue's land was appraised at $204,000.Black also paid $14,000 to attorneys and accountants who assisted in creating this combination.

Required:

Assuming that these two companies retained their separate legal identities, prepare a consolidation worksheet as of December 31, 2018.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q102: Bale Co.acquired Silo Inc.on December 31, 2018,

Q104: How are direct combination costs, contingent consideration,

Q105: On January 1, 2018, Chester Inc.acquired 100%

Q106: Prepare the journal entries to record: (1)

Q106: Describe the accounting for direct costs, indirect

Q108: Jernigan Corp.had the following account balances at

Q110: How is contingent consideration accounted for in

Q110: The following are preliminary financial statements for

Q111: How are bargain purchases accounted for in

Q116: Assume that Bellington paid cash of $2.8

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents